BOILER ROOMS CURRENTLY TOUTING FOR ‘INVESTORS’ IN ALZHEIMERS CURE

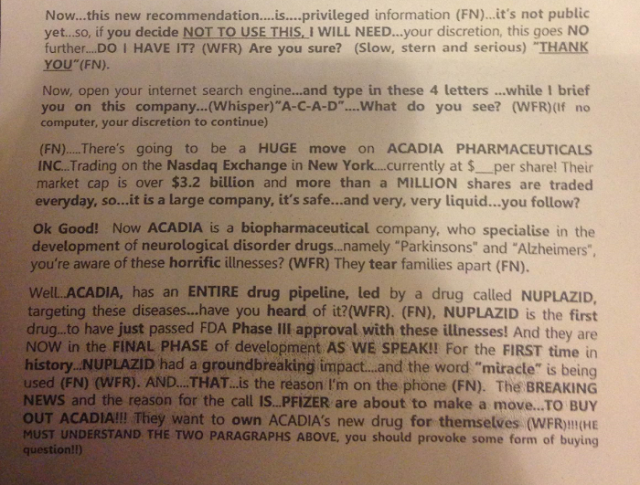

Asia’s infamous boiler rooms have begun offering ‘not to be missed’ shares in a pharmaceuticals firm developing a new drug to combat Alzheimer’s disease.

If anybody wants to buy shares in Acadia Pharmaceuticals do not buy through a telephone cold caller- and especially one reading a script like the one below apparently calling from a room in the Koppel Building in Jakarta.

If anybody wants to buy shares in Acadia Pharmaceuticals do not buy through a telephone cold caller- and especially one reading a script like the one below apparently calling from a room in the Koppel Building in Jakarta.

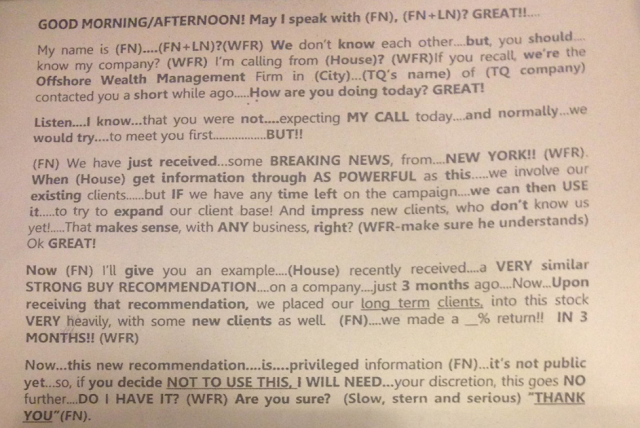

For starters this guy is claiming a merger is imminent with Pfizer which will send the stock through the roof. Of course if that were to be true it would be insider trading and what fool would tell any old punter that.

In this instance Arcadia is being offered by Coles Asset Management which on its website boasts offices in China and Tokyo. Coles Asset Management also shows on an internet fraud site – so it may be changing its name shortly. It has a similar name to a genuine company.

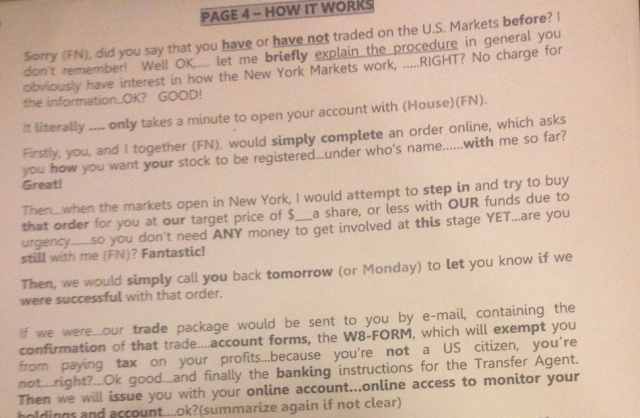

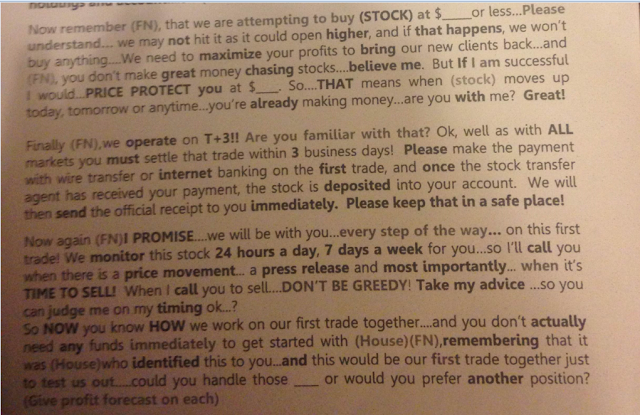

The script was written to be tailored by several boiler rooms – and this is one of the ways the business is going. Several, who have made their millions over the last decade or so, like one or two operators in Bangkok known to readers here, are now selling their knowledge, complete with scripts – and now let others handle most of the calls. In this case there has been a leak at the seller’s end.

You have been warned.

“Now this new recommendation is is privileged information..it’s not public yet so if you decide not to use this I will need your discretion”

(whisper) A.C.A.D..WHAT DO YOU SEE?

FRANKLY I WOULD BE CRAZY NOT TO USE IT TO BUILD MY CLIENT BASE!

AND ALL YOU PAY IS 1%!

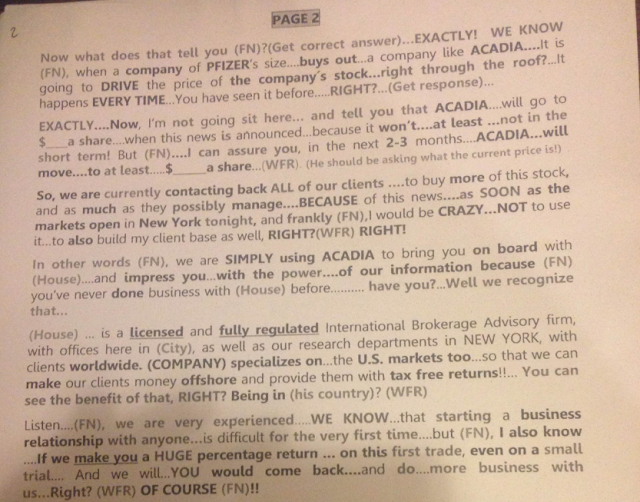

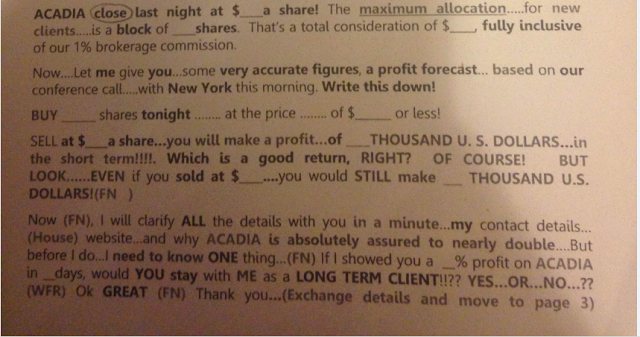

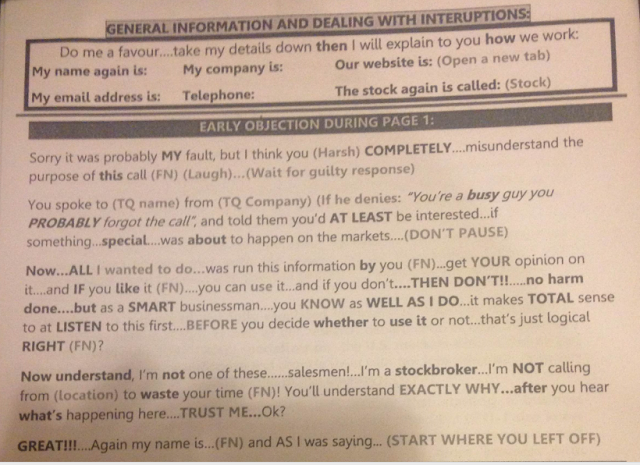

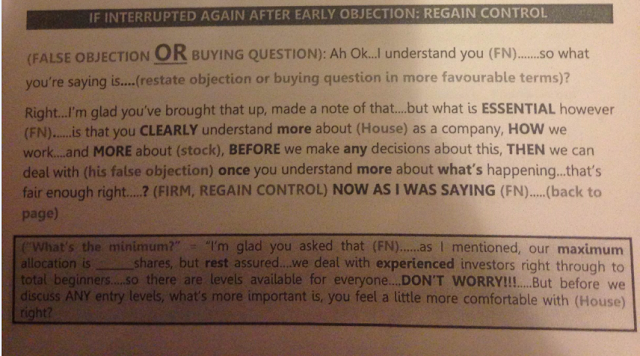

The script as usual comes complete with stage directions

Here’s a reminder from EconomicFrauds.net (but do not pay their ‘research fees’)what to look for in boiler room scams. But if you get a call offering you shares – that is illegal in itself in many countries.

Boiler Room Tactics

Scams and Frauds Involving High Return Investments

Scam artists will do anything to gain your trust in order to entice you to invest in their schemes. They may make promises of huge profits from investing in offshore markets and may even guarantee the returns to give you a sense of security. They are aware of the large amounts of money you pay in taxes and your frustration with earning low returns. They will pretend to share your opinions and sympathize with your frustration.

In one example, farmers were approached through investment seminars about offshore opportunities with guaranteed returns of 15%. One potential investor was told that the large banks use depositors’ money to invest in these same offshore markets for their own profits.

When someone offers you returns that are more than the going rate, there is more of a risk that you will lose your money. Are you taking on more risk than you can afford?

There are several red flags you can watch out for when evaluating investment opportunities, so make sure you know the risks.

Offshore investment opportunities – once you send your money out of the country, you lose any protections provided by the federal laws. Frauds and scams frequently involve an offshore institution to make it more difficult to trace the transactions. Once your money is in someone else’s control you may have difficulty getting it back.

Unsubstantiated guarantees – a guarantee is only as good as the person or company making the guarantee, and their credit rating. If they can borrow money from the bank at 8% and invest it at 15%, why are they willing to pay you 15% on your money?

High return and low risk – the higher the promised return on an investment, the greater the risk. If you think that a guarantee lowers your risk, read about unsubstantiated guarantees, above.

To protect your money:

Be wary of investment opportunities that offer guaranteed high returns and low risk.

Check out the investment opportunity and the registration of the person or company offering you the investment.

Be on the Alert for Boiler Room Tactics

If you get an unsolicited telephone call about an investment opportunity, be alert to the signs of fraud. You might be a target of a boiler room operation.

Boiler room operations wear many disguises and they are once again rearing their ugly head in. Boiler room operators hope to give you a false sense of security with promises of quick profits – but the only ones that profit are the scam artists, at your expense.

They may be located in the financial district near reputable firms, but their address may be nothing more than a rented space tucked away from the public eye. Rarely, if ever, are the offers they peddle to your benefit. Why would a complete stranger call to offer you a no-risk, high-return investment? It is too good to be true.

To gain your trust, the salesperson may boast of a business idea that sounds probable – perhaps a company in the medical industry with a new technological breakthrough for detecting cancer. The pitch is that with your investment, the company could go public on the stock exchange and make you more money. The scam artist may also try to play on your sympathies – he or she may know that cancer has taken the life of someone dear to you. Or perhaps they know that you are a busy professional, with extra income to invest and little time to do your own research. Regardless of the background, the investment opportunity will be sold on the promise of quick profits.

If the offer is really such a great deal, there should be no need for a broker to cold call strangers to promote it. Ask yourself why they are calling you.

To avoid becoming a victim of a boiler room, watch out for:

Unsolicited phone calls. Don’t be afraid to tell a salesperson not to call again, or simply hang up.

High pressure sales tactics and repeat callers. Take the time to research any investment opportunity and get a second opinion.

Promises of high returns with no risk. Any investment that offers returns higher than the bank rate has risk. If you invest in a high-risk investment, you must be financially prepared to lose your money.

Setups. With the first call, the scam artist may only try to gain your trust by offering information about the company and their alleged success. This is a setup for future calls, when you will be pressured to buy.

Unregistered sales persons. Check the registration of the person offering you the investment.

If anybody wants to buy shares in Acadia Pharmaceuticals do not buy through a telephone cold caller- and especially one reading a script like the one below apparently calling from a room in the Koppel Building in Jakarta.

If anybody wants to buy shares in Acadia Pharmaceuticals do not buy through a telephone cold caller- and especially one reading a script like the one below apparently calling from a room in the Koppel Building in Jakarta.

Ironic that your article should reproduce advice from "economicfrauds.net", itself a so-called "recovery room" designed to prey on those who've already been ripped off by the boiler rooms.

In return for a series of fees, they claim to be able to instigate legal proceedings on your behalf in any jurisdiction to recover lost capital. They ask for €500 here, €1500 there to satisfy the legal costs of your "case" until you start asking for tangible results and then you never hear from them or your fees again.

That said, the advice is sound. 😉

Thanks Marlo. Its not a recovery room but I have put a not up to people not to pay – as this stuff is for free on the net anyway – including here, often first

Invaluable advice Andrew.

Anyone thick enough or desperate enough to send a wad of his cash to an unsolicited caller is likely unsophisticated enough to believe the jive-ass patter that goes along with it.

But it does have entertainment value.

I must be on a few these call lists.

When they catch me and I have nothing better to do I enjoy stringing them along. There's a million ways to "flash your tits" for these sociopathic numpties. My record for wasting one of these wipe-rags valuable time is just under three hours in four calls.

About fifteen years ago I'm pretty sure I had a drink with one of these cone heads in Bkk's soi 7 Wave Bar. He was a (cough) wealth manager of course, sporting the requisite cheap tie and knock-off Polo shirt at 3 pm on a Sunday.

I listened to him until my solo Boston table came up. Invited him to play. Took his last 500 THB and then

reminded him that we'd had a little phone chat a few months back.

He said he was Bahamian. Had a Jamaican accent. Buddies with a Canadian (anyone know ex "Vag" LB ?) that I knew was a scammer.

You can usually tell by the shoes or the too-tight collar, the bad hair, the overall "missed-a-spot-shaving-there-buddy" grooming and their generally "Dollar Store" affectations and lack of any knowledge about banking and or finance.

I show them no mercy.

I am a bad man, Andrew.

Yes – that was one of their favourite haunts – but went and ThaiVisa (nominally anyway) opened across the road. But is was also attended by De Vere boys – which was just as bad.

I'd be interested to know of anyone else who'd discovered the hours of family fun that can be had beating these financial advisors and wealth managers at their own game. The faux-Bahamian with the Jammy accent I refer to above had a name for "hot prospects" who string these call centre weenies along, waste their time, raise their hopes and then ridicule their dumbass talking points.

One can start this fascinating hobby with simple requests for clarification of some of the unbelievable tripe they lay out. Don't hammer them right away. Repeating the talking point with an example from your own situation is especially rewarding. Talk a bit of money when you do it.

Just do not give out any additional information about yourself. Roll (or, if you will, "role" ;-)) the useless cabin boy. With some luck and some skill you can help him burn up the valuable office time when he has access to the gang's Phorne Banks ;-).

At some point you'll get bored with the guy's repetitious mediocre jibber jabber and you'll want to lower the boom.

Resist this.

In your most polite tone, ask to speak with someone who can answer some of the clarifications you need before you make that first "good faith" bank transfer of $10000. (From a bank you do not name and use)

If you're lucky enough to be "on" with a floor boss or a closer at some point, keep it short. . . . . one question, one explanation some pleasantries. Some chit chat of your own to your new friend(s) . . . . . Premier League comings and goings, and other sports gossip is a surprisingly effective time-waster with nearly all of these douchbags. Anyway, It's all about rapport, right 😉

But no answers to direct questions like which ? where ? when.

("I have to sell some shares". "We've just sold the country house and we were looking to place the cash from the sale" are splendid gob-stoppers.)

If you succeed in wasting enough of this Internet Pustule's time and a bit of his captain's time and maybe even going higher to a "closer" (keep mentioning that legacy from aunt Eunice or that sale of your house since the kids left you with an empty nest . . . . . . Trust me. They're greedier than the poor guys they prey on. They'll never drop the phone call or cut it off.

A notepad by the phone is helpful.

At some point you will get bored.

Here's what you do.

Direct them to that pack of Soi dogs south of the Asoke intersection and identify the most disease-ridden member of the pack.

Quickly, before he catches on, suggest to your new friend that a surprising level of personal satisfaction can be his for the taking if instead of heading off to Dr. BJ's he gets right down there and applies his carnal skills to man's best friend.